Individual 1e executive pension plans put business owners and company managers in the driver’s seat in the super-mandatory portion of the second pillar. Learn more about the key features and countless benefits of this solution and how it can be tailored to your needs.

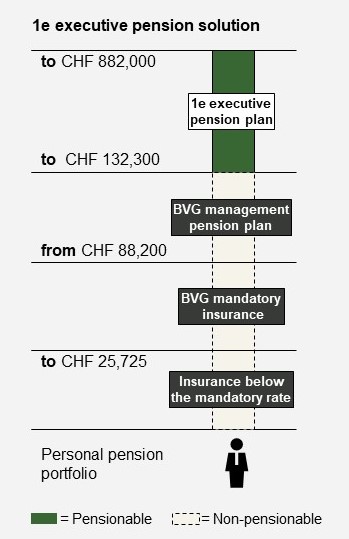

If you own a business or work as a company executive and earn more than CHF 132,300, you and your company qualify for an individual 1e executive pension solution from Agilis 1e Collective Foundation.

Ideal for companies that want to offer their employees or middle managers an innovative retirement solution.

Wages between CHF 132,300 and CHF 749,700 are pensionable.

Every company has its own pension scheme and designates Bank Vontobel as the asset manager.

Every pension account holder selects their own investment strategy under Art. 1e BVV 2.

The pension account holder can choose among as many as 10 investment strategies, including at least one low-risk strategy. Individuals with the same strategy (within a given pension scheme) must have the same returns.

Pension account holders’ assets are independent, fully segregated from one another, and not affected by the risks taken by other pension schemes.

Every pension account holder enjoys maximum transparency with regard to returns and costs.

The 1e executive pension solution is named after Art. 1e BVV2, on which it is based. The solution can be characterized by three key features: investments, insurance and tax optimization.

Investments

The law provides some flexibility in selecting an individual strategy for investments. Pension account holders at affiliated enterprises can choose from nine of up to ten possible investment strategies, picking the option that best suits their personal risk profile and investment horizon. The foundation provides access to extensive customization and professional asset management with Bank Vontobel Ltd as its asset manager.

Insurance

Agilis 1e Collective Foundation provides many ways to fine-tune the pension plan for each affiliated company. For example, death and disability benefits and the retirement savings process can be perfectly coordinated with the basic pension fund and adjusted to reflect actual needs.

Tax optimization

Pension account holders and companies receive tax breaks on regular and extra contributions to pension funds and benefit from transferring assets from companies to individuals through wages and dividends instead of just through dividends.

Contact us – we will be happy to talk about your own personal situation.