In the extra-mandatory area of the 2nd pillar, entrepreneurs or management members have got a variety of structuring options with an individual executive pension plan. Take back control of your pension provision. Agilis 1e is a collective foundation advising you in a personal, individual and comprehensive way. Our solutions also include attractive fees, great flexibility and advanced digitalization.

Does your pension fund sometimes feel like a black box? Do you know what investments your pension fund holds? How much of your total assets consist of retirement savings?

As a business owner or executive, you are used to making your own decisions and assuming responsibility. However, what counts for everyday working life is often the exception when it comes to pension provision. This is precisely where the pension solution in the extra-mandatory 2nd pillar of Agilis 1e Collective Foundation comes in. We offer you more transparency and more freedom to customize your pension solution, select your investment strategy and reduce your tax burden.

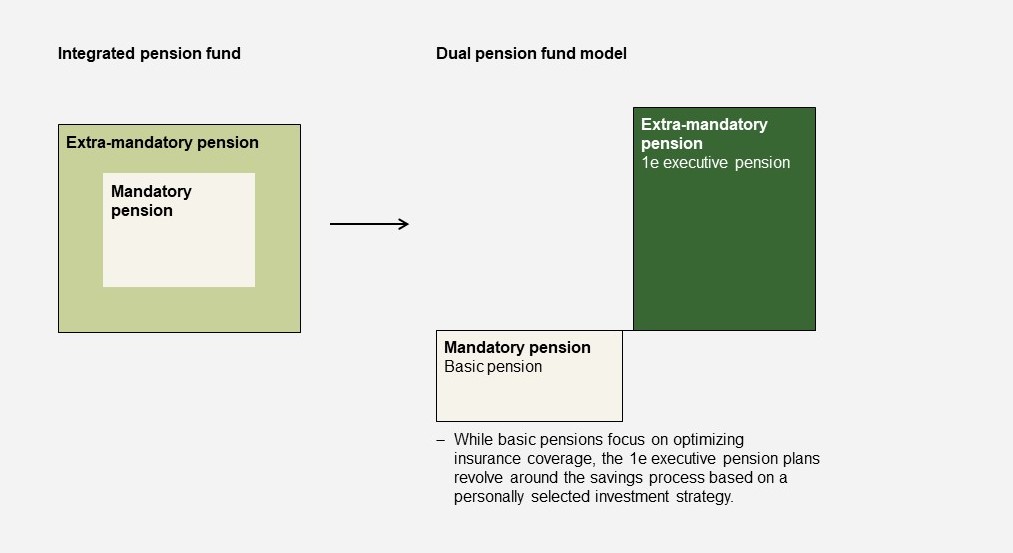

By separating basic and extra-mandatory pension plans, you avoid cross-subsidizing inflated pension promises in mandatory occupational pension programs. For the salary components in the extra-mandatory scheme, you as the insured person have your own personal pension portfolio and choose from a maximum of ten investment strategies based on your risk profile. Voluntary contributions made are credited in full to the personal pension portfolio.

Agilis 1e Collective Foundation is an efficiently structured collective foundation. You can draw on our extensive experience, deep expertise and a client-oriented team. With our lean organization without an in-house sales organization, we avoid unnecessary duplication and can pass on the resulting cost benefits to our pension fund members.

We consider the 1e executive pension solution to be the most important innovation in the pensions sector in recent decades. Thanks to digitalization, we see many opportunities in the coming years to bring the wide-ranging pension business even closer to our customers and raise awareness of pension provision.

Risk premium

The attractiveness of a risk premium can be assessed by obtaining quotes from several providers and comparing them with each other. As a prerequisite, however, it must first be defined which risk benefits are to be insured in the event of disability and death. It is advisable to discuss this issue with a specialist, as certain benefits may be more important depending on the group of insured persons and their personal situation.

As soon as these parameters have been defined, bids can be obtained and compared. This can often reveal considerable differences.

Savings contributions

The level of savings contributions is determined by the employer. Agilis 1e offers the option of elective savings plans, whereby the employer contribution in each savings plan must be the same and make up at least 50% of the total contribution. Higher savings contributions are often defined for 1e plans than in the basic pension plan. The law stipulates that the savings contributions may not exceed an average of 25% across all age categories. In practice, linear savings rates are generally defined.

High savings contributions are attractive because they increase the purchase potential. In turn, a high purchase potential is interesting because the voluntary contributions made each year can be deducted from taxable income.

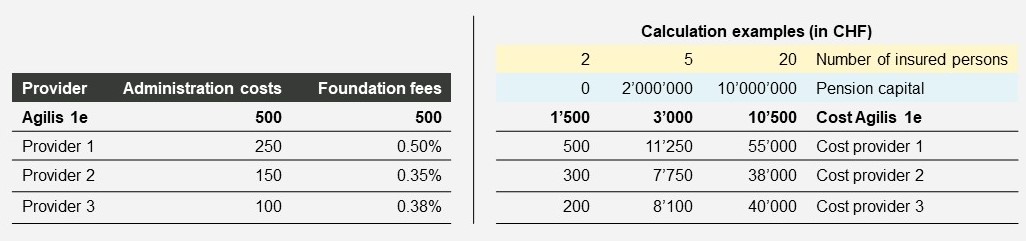

Foundation fees and administration costs

Many 1e providers charge a foundation fee. This is calculated as a percentage of the pension assets, which means that the costs for the overall affiliation are likely to rise over time.

As a rule, an annual lump sum must be paid per insured person for administration.

With Agilis 1e, these two cost factors are combined and charged as a lump sum as follows:

The following comparison table shows how the costs of Agilis 1e and comparable providers will develop depending on the number of insured persons and the amount of pension capital.

The examples in the table show that the foundation and administration costs of Agilis 1e remain very stable over time, as the amount of pension assets is not taken into account. This makes the foundation particularly interesting for companies that already have a 1e solution or those that are starting out without retirement assets but will grow rapidly due to voluntary contributions and high savings contributions.

Investment solution

As already mentioned, individual pension accounts/custody accounts are managed for each insured person as part of a 1e affiliation. Insured persons can choose from up to ten investment strategies, whereby one of the strategies offered must be low-risk (in accordance with Article 53a BVV2).

Before concluding a 1e affiliation, the employer must decide which (maximum 10) investment strategies should be made available to the insured persons.

It is also important to pay attention to the following costs when selecting a provider:

It is therefore important to analyze the investment return in terms of costs (product costs, asset management and foundation fees) in order to be able to compare the medium to long-term performance of asset managers.

Exit from a 1e affiliation

Before joining a 1e foundation, it should be clarified what will happen to the invested pension assets in the event of the employee leaving the employer and pension plan. Only in rare cases does the new employer also offer a 1e solution to which the departing employee can contribute their capital. It is therefore crucial that the foundation and its asset manager offer one or more options in which the portfolio does not have to be realized (at an inopportune time) upon departure and a loss may have to be accepted.

As the custodian bank of Agilis 1e, Vontobel offers the option of transferring 1e pension portfolios unchanged to a vested benefits foundation. This guarantees an equivalent follow-up solution. Even in the event of withdrawal on retirement, the pension portfolio can be continued largely unchanged in the free assets.

Other services for employers and employees

Finally, before deciding in favor of an (alternative) 1e solution, it is important that you get an idea of what support the insured persons and the employer (especially HR) can count on from the foundation and custodian bank.

For the insured person:

For the employer:

Opt for our 1e extra-mandatory pension solution now and take back responsibility for your pension provision.

Agilis 1e Collective Foundation was established in 2009 as a joint foundation serving the super-mandatory segment of the occupational pension market.

Individual 1e executive pension plans put business owners and company managers in the driver’s seat in the super-mandatory portion of the second pillar.

Our downloads page contains the latest important and informative documents and regulations that form an integral part of the affiliation agreement.